Brockhaus Technologies (ETR: BKHT): acquiring and elevating technology leaders

Management with 30% Ownership, Extensive Experience, and a Serial Acquirer Strategy

Investment thesis in a nutshell

Brockhaus Technologies, a company focused on acquiring technology leaders in Germany, boasts an exceptional management team and currently carries a quite depressed valuation. According to my calculations, Brockhaus has an estimated potential of 90% (Target price: €41/share).

Key strengths of Brockhaus include:

An outstanding management team, holding a 30% stake in the company, with a noteworthy track record.

Two companies experiencing spectacular and reasonable expansion, namely Bikeleasing and iHSE.

A significantly low net debt, creating opportunities for potential future acquisitions.

While not discounted in the thesis, the prospect of new acquisitions is real, given the company's modest net debt of only 20 million.

The anticipation of an increase in share price, coupled with an expansion in size and institutional coverage, should contribute to enhancing trading multiples and market visibility.

Disclaimer: This website and/or article do not provide any investment recommendations. Nothing included should be taken as a basis for making investments or decisions. The information contained in the site/article is purely for informational and educational purposes. Before deciding on any investment, you should obtain proper and specific professional advice and conduct your own analysis. You are solely responsible for your investment decisions. The author owns shares of Brockhaus Technologies.

Brockhaus Technologies’ business: a serial acquirer

Brockhaus Technologies (ETR: BKHT) is a German company with a market capitalization of approximately 240 million euros.

Its objective is to acquire and build rapidly growing, high-margin technology companies in Germany under the umbrella of the holding company with the same name. In other words, it operates as a "serial acquirer," or simplifying further, one could almost consider it a publicly-traded private equity fund.

Founded in 2017 by CEO Marco Brockhaus and several collaborators, Marco is a seasoned professional in the investment industry. More information about him is provided below.

What caught my attention about this company, aside from its CEO and impressive track record, is that the holding employs only 11 people. It is a small team with an extensive network, highly focused on acquisitions, as we will explore.

Since its establishment in 2018, they have acquired three companies (Palas, IHSE, and Bikeleasing) and divested one (Palas) with substantial profits, as detailed later.

But before delving into the acquisitions and divestitures, let's get to know the founder and CEO of Brockhaus Technologies, Marco Brockhaus.

Marco Brockhaus, CEO and main shareholder of the company

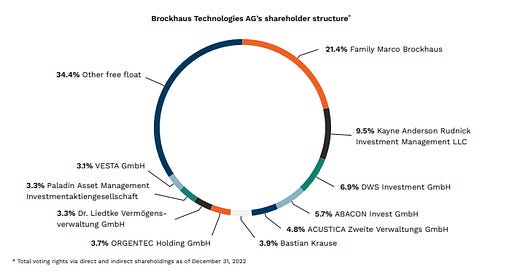

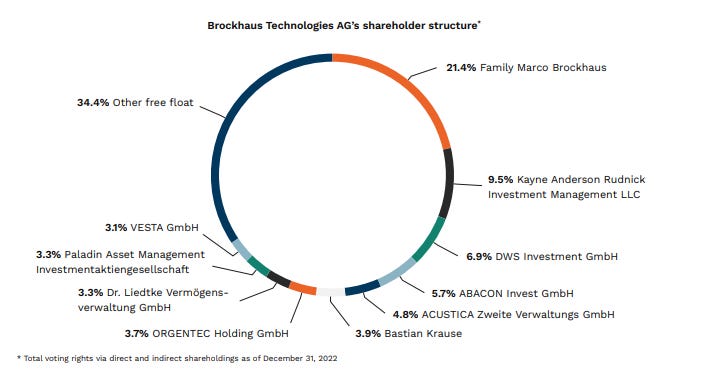

Marco Brockhaus and his team, as well as part of the supervisory board, are the main shareholders of the company. They own more than 30% of the shares. For example, Bastian Krause, co-CEO of the main investee, Bikeleasing, holds 4%.

This is called "skin in the game." Marco is putting his own reputation on the line with the company's name and his money, more than €50M directly invested.

But... who on earth is this Marco Brockhaus? Why does the company bear his surname?

I could explain who he is. But it's better if you hear it from the three private equity funds he has led in the last 20 years:

Marco managed to multiply the capital of these funds between 2 and 3 times, with average internal rates of return of 30%, and in the case of the first fund, exceeding 50%!

How did he do it? Talent and acquisition networks.

He sets his sights on promising companies, negotiates favorable deals with founders (as we will see, Bikeleasing is a quintessential Brockhaus investment), and boosts their businesses. And then he sells them. It sounds simple, but it isn't.

And why did Marco transition to the stock market if he was doing so well with funds? Well, because now Brockhaus has the potential to own its assets over an infinite time horizon, whereas with a fund, you have specific timelines and must sell when necessary. In other words, they used to work within investor constraints, charging a fee, and now they work for themselves without limitations.

I'll now share their strategy to achieve all this, their vision, their acquisition and growth strategy, as well as the company outlook.

Business strategy: acquisitions plus business optimization

"Acquisition Strategy and Vision: 'Elevating Champions'

The company exclusively focuses on acquiring innovative technology companies, or 'champions,' with highly profitable B2B business models characterized by an EBITDA margin exceeding 30% and robust revenue growth, surpassing 20%. Brockhaus aims to acquire the majority of the target company, preferably 100%.

Brockhaus evaluates over 100 transactions annually and executes only 1 or 2 acquisitions per year. The company targets businesses with an EBITDA ranging from 3 to 30 million per year and transactions within the €30-300 million range, allowing for some flexibility. Hence, it acquires assets at a 'relatively' low cost."

Brockhaus’ remarkable business ventures

Since its inception as a spin-off from its fund management company, Brockhaus Technologies has invested in three companies.

Palas (sold in 2022, multiplying the investment by x4)

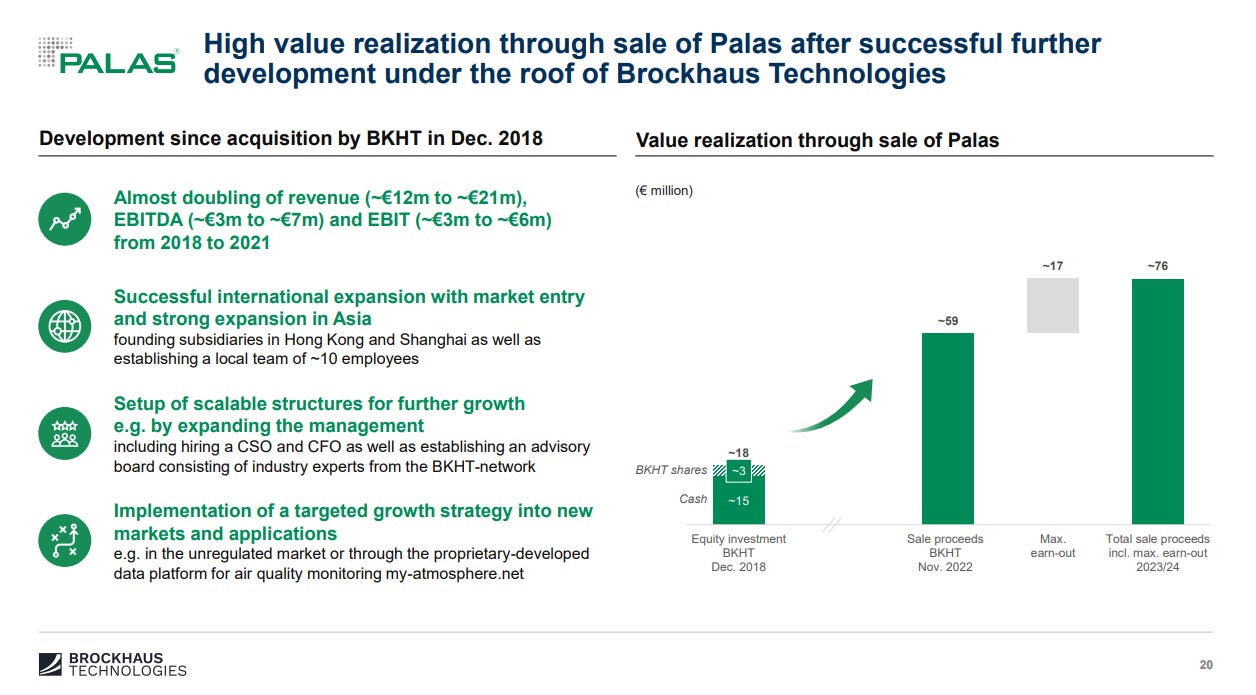

In 2018, Brockhaus acquired Palas, a German company specializing in the development and manufacturing of equipment for measuring, characterizing, and generating particles in the atmosphere. The Palas acquisition allowed Brockhaus to expand its product and service range and strengthen its position in the global air quality measurement market.

Within four years, the company had doubled its results.

In 2022, Brockhaus sold its 70% stake in Palas to the Swedish company Indutrade AB, achieving a multiple of the invested money between x4-x5 (from €18 million to €59-76 million).

Bikeleasing

In 2021, Brockhaus acquired a 52% stake in Bikeleasing for €180 million.

Founded in 2015, Bikeleasing is a digital platform that provides a service to companies: businesses can offer bikes to their employees as a benefit. Bikeleasing takes care of everything, including insurance and leasing, acting as a subcontractor for the company.

Therefore, companies provide this service as they would provide health insurance.

Bikeleasing primarily acts as an intermediary, providing flexibility to workers, financial institutions, bike suppliers, and companies, while eliminating/simplifying any investment costs for the latter through the leasing model. This model, in Germany, also comes with strong tax incentives, making it even more attractive given environmental trends due to climate change.

Figures for 2023: expected revenues of around €140-150 million and over €60 million in EBITDA and €55 million in EBIT. Adjusting for Brockhaus' stake, this translates to around €30 million in EBITDA and €27 million in EBIT for 2023, respectively.

Remember that the current market capitalization of Brockhaus is €240 million, so this would imply an EV/EBIT of around 8-9x, without considering cash or the iHSE business!

The question is how much it will scale in Germany and whether its model is 100% exportable, something that, in my opinion, we will see soon. For now, growth is at 90% levels.

iHSE

In 2019, Brockhaus acquired iHSE for approximately €110 million (€135 million Enterprise Value, considering debt). Once again, the outgoing management agreed to stay and continue leading the company.

iHSE is a technology leader providing hardware for installations that require high security in data processing, such as air traffic tools or data centers.

iHSE has faced several "crises" in recent years (Covid, supply chain disruptions). Therefore, in terms of EBIT, for 2023, we would be looking at an estimated €8 million in EBIT. This figure is below the target, but I believe the company still has great potential, as evidenced by the rebound it has experienced.

Valuation

Considering that we are talking about Germany, growing businesses, renowned management... the company currently has a very low valuation. Let's remember that we are also discussing a high-quality software business with high margins and a defensive moat at its level.

For the valuation, we will perform a sum-of-the-parts analysis (iHSE + Bikeleasing + Holding) using both multiples and discounted cash flow models.

Multiples

Potential Upside of Nearly 65% in the Short/Medium Term and 170% in 2 Years

Considering the estimated EBIT and EBITDA for iHSE and Bikeleasing, we would have the following implied multiples:

Multiples for 2023

Estimated EBITDA: €10M for iHSE and €30M for Bikeleasing = €40M vs. €250M = ~6x EV/EBITDA

Estimated EBIT: €8M for iHSE and €27M for Bikeleasing = €35M vs. €250M = ~7x EV/EBIT

Multiples for 2025

Estimated EBITDA: €60-80M = ~3-4x EV/EBITDA

Estimated EBIT: €50-70M vs. €250M = ~4-5x EV/EBIT

Comparing these, and believing in the estimated growth more or less, the multiples would be quite favorable. Let's take a look at the values (I have included very conservative values for 2025, although the company should achieve €60M in adjusted EBITDA):

At these values, we would need to subtract net debt. To be conservative, we will adjust by €50M, assuming no further acquisitions and a more conservative cash position for the company (as of September 2023, there is €20M in net debt). Additionally, let's assume that the cost of the holding is €5M per year, directly affecting EBITDA, as assumed above.

With these adjustments, and considering that for businesses of this type in Germany, and applying a slightly lower EV/EBITDA than what they paid, we would obtain:

~€400M market capitalization by 2023 (around 65% potential upside)

~€650M market capitalization by 2025 (around 170% potential upside)

Discounted cashflow

Base Case with a 100% Upside.

Using a straightforward 5-year discounted cash flow model, I obtain the following results

This includes conservative assumptions regarding the discount/cost of capital, considering it is Germany.

Current share price and risks

The stress case shows that if the cost of capital increases significantly or the company encounters challenges in fulfilling its growth plan, we would be logically exposed to losses. However, I believe that, based on the quality of its businesses (especially Bikeleasing), this scenario of diminished growth, while possible, is by no means the most likely. In any case, in such growth-dependent companies, close monitoring of growth evolution and potential impacting factors is crucial.

Standard risks apply to the company’s business - Brockhaus could be affected by general market conditions and macroeconomic factors that might be beyond its control, such as economic recessions. Additionally, given the nature of the technology sector, intense competition and any significant new advancements could impact its business.

While the growth strategy is dual (organic and inorganic), Brockhaus' main activity revolves around acquisitions. Depending heavily on these transactions, the company's success could be tied to its ability to identify and execute profitable acquisitions, using the cash flow received appropriately.

In my opinion, Brockhaus' "cheap" valuation is due to various structural reasons.

The company is small, with low trading volume, issued few shares in its IPO, and has stable management and majority shareholders. It's relatively illiquid. Additionally, its public track record is limited, with little analytical coverage; it is not widely known. The market's perception of potential share issuances for growth through acquisitions has also impacted the valuation, although the management prefers smaller acquisitions and avoids issuances unless exceptional opportunities arise. These dynamics have created the current investment opportunity, and in my opinion, if growth and new acquisitions occur, there will be new catalysts.

Valuation summary

Market capitalization value of €450M, equivalent to a per-share price of €41.3, with a potential upside of 92%.

Conclusions

With an estimated growth potential of 90%, my opinion is that Brockhaus Technologies could represent a compelling opportunity.

Brockhaus' strength lies primarily in a top-notch management team, whose 30% ownership in the company demonstrates significant commitment. Additionally, the inclusion of two rapidly expanding businesses, Bikeleasing and iHSE, adds an extra layer of robustness to this team.

Its sound financial position not only provides stability but also opens the door to potential future acquisitions that could further drive growth.

Brockhaus' solid track record, consistently surpassing its own projections, instills confidence in the company's ability to execute its business plan. Furthermore, the growth of its subsidiaries, the expansion of its size, and institutional coverage should act as catalysts for its valuation and visibility in the market.